Solutions for the Financial Sector

In the financial industry, protecting sensitive data is a top priority due to the constant threat of cyber-attacks. Financial institutions handle highly sensitive information, from client records to transactional data, which makes them prime targets for cybercriminals. DataLocker’s suite of encrypted storage, mobile USB drive management, and secure access control solutions offer the comprehensive security financial organizations need to protect their critical data and remain compliant with strict regulatory standards.

Finance Use Cases

General Security and Data Protection

- Challenge: Financial institutions handle large volumes of sensitive data, including client financial records and transaction details. Ensuring that this data remains secure from unauthorized access and breaches is vital to protecting clients and maintaining compliance.

- Solution: DataLocker’s encrypted drives and SafeConsole platform provide financial institutions with robust security, allowing administrators to monitor, audit, and control data access across all devices. With AES 256-bit encryption and centralized management, financial organizations can implement consistent and scalable security protocols.

- Result: Financial institutions can effectively protect sensitive data, achieving enhanced data security and maintaining trust with clients. DataLocker’s solutions support compliance with regulatory requirements, reduce the risk of data breaches, and enhance the overall security of critical financial information.

Encrypting Remote Worker Data

- Challenge: With remote work becoming more prevalent, financial organizations need to secure data on devices used by remote employees, as these devices are more vulnerable to unauthorized access and data breaches.

- Solution: DataLocker encrypted USB drives offer secure, hardware-based encryption, allowing remote workers to store and access sensitive data safely. SafeConsole’s remote management enables administrators to lock or wipe devices as needed, protecting data even if a device is lost or stolen.

- Result: Financial agencies ensure that remote workers have secure access to data, whether in the office or working from home. DataLocker’s encryption and remote management capabilities provide peace of mind by ensuring data security across locations while adhering to regulatory compliance.

Secure Document Delivery

- Challenge: Financial professionals frequently exchange sensitive documents with clients and partners. Traditional methods of file transfer can expose these documents to interception and unauthorized access.

- Solution: DataLocker’s encrypted USB drives facilitate secure, tamper-resistant file transfers. With military-grade encryption, financial organizations can securely deliver and share sensitive information without risking data exposure. SafeConsole allows tracking and auditing of file transfers for added transparency and security.

- Result: Financial institutions can securely transmit critical documents, preserving the confidentiality and integrity of client information. This secure file transfer method reduces the risk of data breaches and supports compliance with industry standards.

Secure System Backups

- Challenge: System backups are critical for financial institutions as they ensure data recovery in case of disruptions. However, if these backups are not adequately secured, they become a vulnerability that could expose sensitive financial data.

- Solution: DataLocker’s encrypted hard drives, such as the DL4 FE and Sentry K350, provide secure storage for system backups with hardware-based AES 256-bit encryption. With SafeConsole, administrators can manage backup data security policies, enforce access permissions, and audit backup data usage.

- Result: Financial organizations secure their system backups, ensuring data remains protected even in the event of system failure. This adds a layer of redundancy and supports data recovery plans while meeting regulatory standards for data protection.

Why DataLocker for Financial Institutions?

DataLocker provides a tailored suite of data security solutions designed to protect financial organizations from internal and external threats. With military-grade encryption, centralized device management, and secure data access, DataLocker enables financial institutions to meet their unique security needs and maintain compliance across various regulatory frameworks.

Regulatory Compliance

DataLocker solutions meet regulatory standards such as HIPAA, SOX, GLBA, and more, supporting compliance with government and industry-specific security mandates.

Military-Grade Encryption

DataLocker’s AES 256-bit encryption on USB drives and hard drives provides the highest level of data protection, essential for safeguarding sensitive financial information.

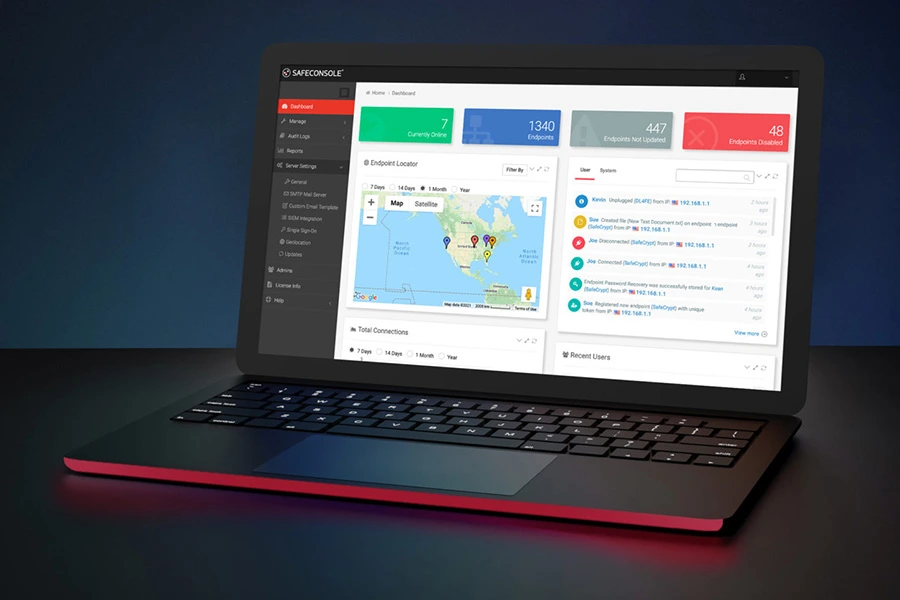

Centralized Management with SafeConsole

SafeConsole offers financial institutions complete control over connected USB devices, enabling them to enforce security policies, monitor device activity, and remotely lock or wipe devices.

Protection for Remote Work Environments

DataLocker ensures that data remains secure across both in-office and remote work environments, adapting to the needs of a modern financial workforce without compromising security.

Secure Backup and Document Transfer

DataLocker’s encrypted storage solutions provide secure methods for system backups and document transfer, helping financial institutions reduce risks associated with data loss and interception.

Get a SafeConsole Demo Today!

Ready to secure your financial data with DataLocker? Schedule a demo to explore how our encrypted storage solutions and SafeConsole management platform can enhance data security and ensure regulatory compliance in the financial sector.

Trusted by